Insurance Claim Problems: Hiring a Public Adjuster Vs. An Attorney

As smart consumers, we can usually sense when we are being given the runaround. Insurance companies are infamous for this, delaying claims, putting you off, denying legitimate claims, or trying to settle a claim for far less than they are worth.

If you are a homeowner or business property owner who has experienced damage or a complete loss and have filed an insurance claim but are having problems getting your insurance company to pay up, you may be at a standstill, wondering what your next move should be. Or you could be in a situation where your insurance provider has completely denied your claim. Another scenario could be that the settlement your insurance company is proposing is far less than you know it should be in relation to the loss you have experienced.

If you find yourself in any of the above-mentioned situations, you may be trying to decide which is best, hiring a public adjuster or hiring an attorney. A public adjuster will most likely be your best move rather than an attorney. Hiring an attorney should be your last line of defense when battling with insurance companies. Lawyers are for litigation, and you are not at that stage of the game yet. For example, according to the Florida Bar, the typical contingency fee cases range from 30% to 40%. On the other hand, public adjusters fees are capped at 2o% in Florida. And just as noteworthy, public adjusters will do all the work attorneys would do but at a lower cost and likely with equal or better results.

Hiring a public adjuster means you will pay nothing out of pocket unless they help you win money from your insurance company, whereas an attorney charges an hourly rate and you will pay this whether they win your court case or not. Public adjusters decode all the legal jargon involved in dealing with the insurance claim. A public adjuster will research and document all damages incurred (including extra expenses accrued by an interruption to your business). They prepare the entire claim and ensure that it gets pushed through by the insurance company. Public adjusters negotiate settlements and will even re-open cases where that has been some discrepancy.

The only time you need to consider hiring an attorney when you are having problems with an insurance claim for your home or business property is if in the rare case your public adjuster cannot get your insurance company to do what they should do by paying you a fair settlement. Noble Public Adjusting Group, as well as being a licensed public adjuster, offers appraisal services if your case gets that far. However, even this is not considered a court case. If we go to battle with your insurance company as your appraiser and we STILL aren’t satisfied with the results, that is the point at where we will advise you to hire an attorney and take the insurance company to court.

Now that you know hiring a public adjuster to handle a problem with an insurance claim is the best solution, rather than hiring an attorney, check out our full process below. If you have already filed your claim and you want us to take over, the process is basically the same, since we will be starting from scratch, just reopening your claim.

How the Noble Public Adjusting Group Process Works

First, you engage our services. All you need to do is visit our contact page or fill out the form below to speak to one of our licensed public adjusters to assess your damages and review your insurance policy.

Paperwork. Once it’s established that there is adequate damage and a “case” so to speak, a contract is signed. No fine print, no fancy wording, just a contract to say you have given permission for Noble Public Adjusting Group to represent you and speak with the insurance company on your behalf.

Retrieve Data. The next step is to “scope” the property; which includes taking pictures, measurements, and other information about your damages. This can be done the same day of your free inspection, or when you’re ready. We work 6 days a week and have flexible meeting hours, so it should be easy to come to an agreement on an appropriate time.

We file your claim. Next, we notify your Insurance Company, send in the appropriate forms and send them our professional damage estimate. Usually, this is when the Insurance company will send out their staff adjuster or independent adjuster to assess the damages and write up an estimate on their behalf. We meet with the Insurance company’s adjuster for an “inspection” at your property to help him/her see all of the damages.

Also, a side note. Vacation homes and condos are common in Florida, so rest assured that we have extensive experience in settling large condo association claims no matter the location of your insurance claim.

Negotiation phase. The staff adjuster’s estimate is then turned in to the higher-ups for approval and they dictate to him/her what will be paid on your claim. This is when the negotiations begin. We do all of the negotiating for you. Negotiation time can range from a few days to a few months, it really depends on how efficient your insurance company is. During this process, our office staff will contact them almost daily by phone and e-mail to check the status of your claim and to ensure that they are working on it steadily. Notes and status updates are recorded in our library of files, where you can log in and see what’s happening with your claim.

Settlement. Finally, there will be an agreement made for a fair allotment. The insurance company will usually, within days of the settlement, issue a check by mail, to you and your Public Adjuster to cover your damages and costs.

Rarely, when the Insurance Company refuses to concede, the claim will move into a phase called appraisal or eventually litigation. But since more than 95% of Insurance court cases rule in favor of the property owner and not the Insurance Company, they will try to avoid litigation at almost any cost. The appraisal is an avenue more commonly used to come to an agreement when neither party will bend. To learn more about what Insurance Appraisal is, please see our Appraisal page here.

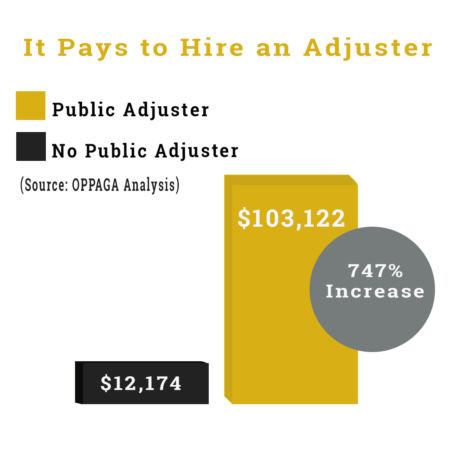

A study performed by The Office of Program Policy Analysis and Government Accountability (OPPAGA) determined that policyholders who use a Public Adjuster receive a 747% higher claim pay-out than those who choose to file their claims alone. That number is astounding. If you want to be counted among those who receive a proper pay-out, contact us today.

Enlist the Largest, Best, Fully Staffed Public Adjuster Firm to Negotiate Your Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

Thank you,

Montanna

If you have any damage it's worth it to call Noble to do the hard work for you...