Property insurance is a vital safeguard against unexpected calamities, from natural disasters to accidents and theft. Yet, when the unfortunate occurs and you must file an insurance claim, the process can be complex, time-consuming, and frustrating. This is where a public adjuster comes into play. In the property insurance industry, a public adjuster serves as an invaluable advocate for policyholders, helping them navigate the complex world of insurance claims.

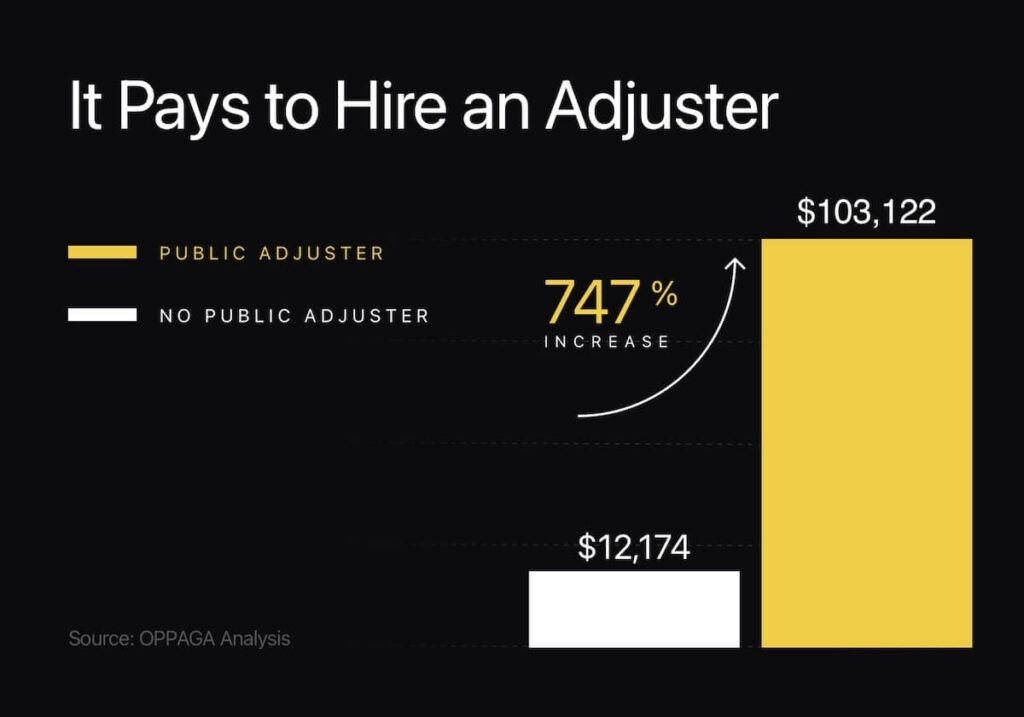

An OPPAGA report indicated that using a Public Adjuster gets policyholders an astounding 747% higher payout than filing a claim without representation.

The Office of Program Policy Analysis and Government Accountability (OPPAGA) is an office of the Legislature providing data, evaluating research, and objective analyses to assist legislative budget and policy deliberations. See full report here.

Insurance companies have their own adjusters that they send out to assess the legitimacy of an insurance claim, called Staff Adjusters or Independent Adjusters. They are very different from Public Adjusters.

The first and most obvious difference is that they work for the Insurance company and NOT the policyholder. Public Adjusters work only for the public and are paid by the public, not the insurance company. It’s also much more difficult to become a state licensed PA than a standard staff adjuster or independent adjuster.

Another major difference is the apprenticeship. Staff and Independent adjusters are not required to apprentice for 6 months or any set amount of time as a trainee. The motive is different, the program is different, the testing is different, and of course the state license and regulation is different. A Staff or Independent can become a PA, but they have to concede to all of the requirements and relinquish their current license as a Staff or Independent Adjuster. They cannot represent both the Insurance Company and the property owner because that would obviously be a major conflict of interest.

Staff and Independent Adjusters can often be one-sided, biased, and nit-picky, scrutinizing the damages to avoid awarding proper payment, or denying legitimate claims all together. The Insurance company they work for keeps record of how much they’re paying out, and if it reaches a certain number, their job could be in jeopardy. So, they’re pressured to keep their claim payouts as low as possible, to save the insurance company money.

Public Adjusters are there to tip the balance scale back the other way, to look out for the interest of the policyholder. No longer are you left at the mercy of a job-scared biased party. A PA can be hired by you, the insured, to assess the claim, negotiate* with the insurance company, and sometimes go to court (as an expert witness) to resolve your claim and get you the money you deserve for restoration of damages.

Noble Public Adjusting Group has everything on the list of finding “the right PA”. But to be fair, you should do some research for yourself. The internet is the best source for finding a PA that represents clients in your area. The typical Google Search is “public adjuster near me” or “best public adjuster near me“. As you begin researching, you’ll find that most PA firms are located in large cities and have many clients. You want to try to use a company or independent public adjuster with a lot of business that is fully staffed. Knowing that a PA has a receptionist and all of the supportive staff one comes to expect from a business is reassuring because it takes resources and reputation to take on the insurance companies. That’s why Noble takes pride in being described as the largest public adjusting firm.

There should be adequate time for focused attention on each client. Noble PA Group has a branch-out policy enabling our public adjusters to focus on a minimal amount of clients at one time by limiting the number of and hiring more qualified desk adjusters or office staff when numbers exceed the set amount.

Our fee comes directly from the money the insurance company awards, so there’s no out-of-pocket expense. Public adjuster fees are regulated according to state statutes that are different in every state, and Noble will clearly communicate the fees with you both in writing and verbally according to the latest state statutes. In any case, if you don’t get paid, we don’t get paid.

Best Reviewed Public Adjuster, According to Client Reviews on Google, Facebook & BBB!

If you would like a free consultation, policy review, and inspection of your property, submit the form and we'll be in touch.

Want to learn more about the process of working with a Public Adjuster? Click below to learn more about the process.

Even if you’re not directly in a major city, we cover many areas and some outside of the state. Click below to see where.

A lot of our what we do appears on our hit TV show “Insurance Wars”. We created this show to shed light on the actual battle between the insurance adjuster and the public adjuster to settle a claim for our clients. “Insurance Wars” allows clients to share their personal stories of their lives being turned upside down after being affected by natural disasters and desperately needing help and advice. The misconception of public adjusters is proven false after Noble interjects the expertise and knowledge our employees provide.

Whether the claim has already been filed, needs to be filed, or has been closed with an unsatisfactory payout; we can represent you at any point in your claim process, even if your claim has been denied.

Using a public claims adjuster increases insurance claim payouts by 747% on average, according to a government study.

Whether the claim has already been filed, needs to be filed, or has been closed with an unsatisfactory payout; we can represent you at any point in your claim process, even if your claim has been denied.

Using a public claims adjuster increases insurance claim payouts by 747% on average, according to a government study.

CALL US NOW!

FL Lic# W140390

GA Lic# 2850276

TN Lic# 2473502

MS Lic# 10677253

SC Lic# 16363172

NC Lic# 16363172

LA Lic# 966654

FL Lic#W628077

GA Lic#3478077

TN Lic#3001728963

MS Lic#10819222

SC Lic#19419366

NC Lic#19419366

LA Lic#970735

TX LIC#2846064

MN LIC#3002141186

WI LIC#19419366

KY LIC#1286618

*Fees are regulated according to state statutes that vary in every state.

*Louisiana RS 22:1706