You Need a Public Adjuster After a House Fire or Smoke Damage

In the wake of the massive wildfire in Eastpoint, Florida on June 24, 2018 a discussion is needed on the basics of house fire and smoke damage insurance claims. This terrible incident prompted us to take things a step further and discuss why you need a Florida public adjuster like Noble if your home has received fire or smoke damage, or has been totally destroyed by fire. This wildfire has been officially dubbed the Limerock Wildfire.

First let us say that if your home or commercial property in Florida has been damaged or destroyed by fire, our hearts go out to you. We have seen firsthand the devastation fire brings, both in lost property and emotional trauma. One way Noble Public Adjusting Group can make things easier on you is to point out crucial reasons you need a public adjuster to file your insurance claim for damages from a fire.

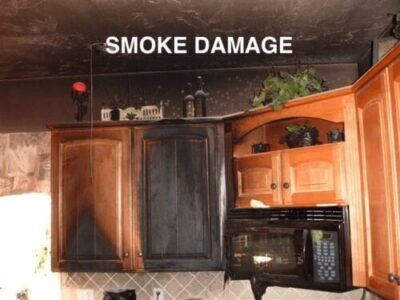

For one thing, fire damage claims are the most complex type of insurance claim. There could be damage or contamination not seen by the naked eye. When evaluating the damages to your home or commercial property caused by a fire, the staff adjuster sent out by your Florida insurance company is not going to be looking for anything beyond the initial, easily viewable damage. Their job is to save their company money, so they will be looking for any way they can to downplay your fire loss.

Things get even more tricky when smoke damage is involved. Smoke damage insurance claims are often difficult to resolve because soot and smoke damage can often not be very visible but can be everywhere. Characteristics of soot vary based on what the source is. One example is soot from burning plastics. This soot is acidic and will cause corrosion on metal items. Smoke and soot can get into every nook and cranny of your Florida home or commercial property. If these harmful elements get into your attic, they can fall into the wall cavity. Soot which is left behind from a fire can be very damaging to your home, condo, or commercial property in Florida, causing health problems for you, your family, or your employees. Left untreated it can get worse since soot eats away at the materials it settles on.

One important aspect of your homeowner or business property insurance policy you should know is that almost all policies are “fire insurance policies” at the core. When you experience a fire, this should help ease your mind. However, one very important thing to remember is that you may, unfortunately, discover that your insurance company is not your friend once you file an insurance claim. By their very definition as a ‘company’, your insurance company is in the business of making money. They will try to find a way to offer you the smallest settlement possible or even deny your claim if they can.

Noble Public Adjusting Group strongly suggests, considering the issues listed above, that you hire us to handle your insurance claim after a fire in Florida. We know Florida extremely well because while Noble’s service locations range across the United States, our corporate office and headquarters is located in Panama City Beach, FL. Insurance can be tricky, but we are experts when it comes to the language of insurance and fire damage claims for both homeowners and business property owners. Once you hire us, we take over your fire damage claim, handling everything going forward. If the fire loss just happened, we will contact your insurance company for you. We will do all the paperwork regarding the claim, and even contact the professionals who will restore or replace your home or business and its contents.

When your hire Noble to represent you as your public adjuster, we will be releasing you from the burden of worry and paperwork. You have enough to deal with after experiencing a fire. If you’ve already received a payment from your insurance company, you may be entitled to more; if you’ve been denied you may have some coverage you didn’t know about. By using us as your Florida public adjuster, you could easily find yourself getting as much as 747% more of a settlement from your insurance company than if you had handled the claim yourself.

Watch “Insurance Wars – Fiery Debate”. A Fire Insurance Claim Episode from Our Hit Reality TV Show

Much of our work is prominently featured on our well-received and popular television program, “Insurance Wars”. This show was created with the primary objective of providing insight into the genuine conflicts that arise between insurance adjusters and public adjusters when they work on claims for our esteemed clients. “Insurance Wars” serves as a platform for our clients to share their personal experiences, recounting the tumultuous situations that arise when their lives are disrupted by natural disasters, leaving them in urgent need of guidance and support.

Through “Insurance Wars,” we aim to dispel common misconceptions surrounding public adjusters by highlighting the extensive expertise and knowledge that our team members bring to the table.

Enlist the Largest, Best, Fully Staffed Public Adjuster Firm to Negotiate Your Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

Thank you,

Montanna

If you have any damage it's worth it to call Noble to do the hard work for you...