Noble Public Adjusting Group always strives to use our blog to inform and educate Florida property owners about all things involving insurance. One question we get asked a lot, when a policyholder we have represented as their Florida public adjuster, is if the insurance settlement they receive is taxable. And this is a very good question. Below we have answered that question in detail:

Is Your Florida Property Insurance Settlement Taxable? – Insurance Claim FAQ

Your property insurance settlement is NOT taxable unless you have a gain from it. The gain is determined by comparing the proceeds of your Florida property insurance claim settlement to the cost of your property and also applies nationwide. Suppose your Florida home costs $150,000 and your gain on the receipt of the insurance settlement money is $50,000. If you use all the proceeds to fix your home (within a specific time period), you would have no gain or loss.

If you use less than the entire reimbursement, you have a reportable capital gain to the extent of the lesser of the unspent proceeds. The reportable gain may be deferred if the property destroyed was the main home that you lived in for two of the last five years. The time period for reinvesting the proceeds in repairs is two years from the close of the tax year you had the gain.

The below information from Insurance Q & A explains in detail why you do not have to pay taxes on an insurance settlement for property loss:

“One basic underlying principle of property insurance is the principle of indemnification or payment to cover your loss. Insurance aims to protect you from a loss. With respect to homeowners insurance, you can expect protection from losses you will incur due to a covered peril such as a fire, a windstorm or hailstorm [or roof damage]. With the principle of indemnification, you are not expected to profit from the insurance. What is being paid is just a reimbursement of what you lost.

That means if you lost a television, the insurance will pay for the television. In some cases, the amount you receive may even be smaller since depreciation is also taken into account. You will also have to pay the deductible. This means that the insurance proceeds are usually not required for reporting to the IRS. If you used the money paid by the insurance company to rebuild your house or replace the contents that were lost, then you don’t need to report what you received as taxable income.”

Noble Public Adjusting Group hopes the above answers to the question of whether you have to pay taxes on a Florida property insurance settlement to your satisfaction. However, if you have further questions about this issue, don’t hesitate to call us. We love hearing from our blog readers, and we will help you in any way we can. If you have a loss at your Florida property, whether as a homeowner or commercial property owner, you need a public adjuster to handle the claim for you, and with very good reason.

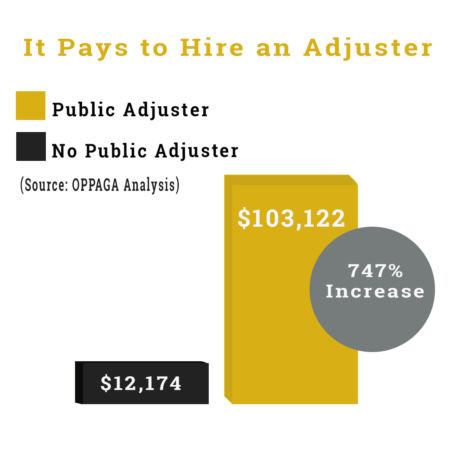

A recent study shows that by using a public adjuster to handle their insurance claim, policyholders receive 747% more of a settlement than when they handle it themselves.

Noble’s Headquarters is in Panama City Beach, FL but we have several other offices in Florida and can handle an insurance claim anywhere in the state. We also have offices in Texas and Georgia. Under the right circumstances, Noble can take on a property insurance claim anywhere in the USA. So make sure to tell your friends nationwide that they should hire Noble Public Adjusting Group if they have suffered a major loss at their home or commercial property.

Give Noble a call today and let’s get acquainted!

Enlist the Largest, Best, Fully Staffed Public Adjuster Firm to Negotiate Your Roof Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione