Weathering the Storm: Hail Damage to Roofs and Navigating the Insurance Claims Process – Why a Public Adjuster is Key

Hailstorms are a natural force to be reckoned with, and homeowners often find themselves grappling with the aftermath of these meteorological marvels. These storms occur often, and for some states such as Colorado and Texas, severe hailstorms are a seasonal way of life. The recent hailstorm storm in North Texas serves as an example of how common it is and the devastating damage these storms cause to homes, and more specifically, to the roofs, which will undoubtedly result in the need for property owners to file an insurance claim.

In this article, we’ll delve into the world of hail damage, exploring the nuances of how these icy projectiles can wreak havoc on your roof. More importantly, we’ll guide you through the labyrinthine process of navigating the insurance claims process for hail damage and unveil the indispensable role that public adjusters play in ensuring you receive a fair settlement.

The Wrath of Hailstorms:

Hailstorms are nature’s artillery, unleashing frozen balls of water with the potential to cause considerable damage. Understanding their formation is the first step in comprehending the destruction they can inflict. Hailstones vary in size, from mere pebbles to golf ball-sized projectiles, and in extreme cases, even larger. These ice missiles can fall from the sky with astonishing velocity, causing damage to your home’s first line of defense – the roof.

Roofing Vulnerabilities

The materials used in residential roofing can vary widely, each with its own strengths and weaknesses in the face of hailstorms. Common roofing materials include asphalt shingles, tile, and metal. Asphalt shingles, for instance, are susceptible to granule loss and cracking when struck by hail. Tiles may crack or shatter, while metal roofs can suffer dents and dimples. The severity of damage depends on factors like the size of hailstones, their speed, and the type of roofing material.

Detecting Hail Damage

After a hailstorm, it’s crucial for homeowners to inspect their roofs for damage. While some signs of damage may be visible from the ground, such as dents or dislodged granules, a professional inspection is often necessary for a thorough assessment. Roofing experts can identify subtle signs of damage that might escape an untrained eye, ensuring that all issues are properly documented for your insurance claim.

The Insurance Claim Process

Filing an insurance claim for hail damage can be a labyrinthine process, especially for those unaccustomed to navigating the intricacies of insurance policies. The first step is timely reporting; waiting too long after the hailstorm can lead to claim denial. Documenting the damage with photographs and detailed notes is crucial for a successful claim. Once the claim is filed, an insurance adjuster will be assigned to assess the damage and determine the payout.

The Role of Public Adjusters

Public adjusters are unsung heroes in the world of insurance claims. They are licensed professionals who act on behalf of policyholders, not the insurance company. Their primary role is to advocate for homeowners and ensure they receive a fair settlement. Public adjusters possess an intimate knowledge of insurance policies, claims procedures, and the negotiation skills needed to maximize your claim.

Benefits of Hiring a Public Adjuster

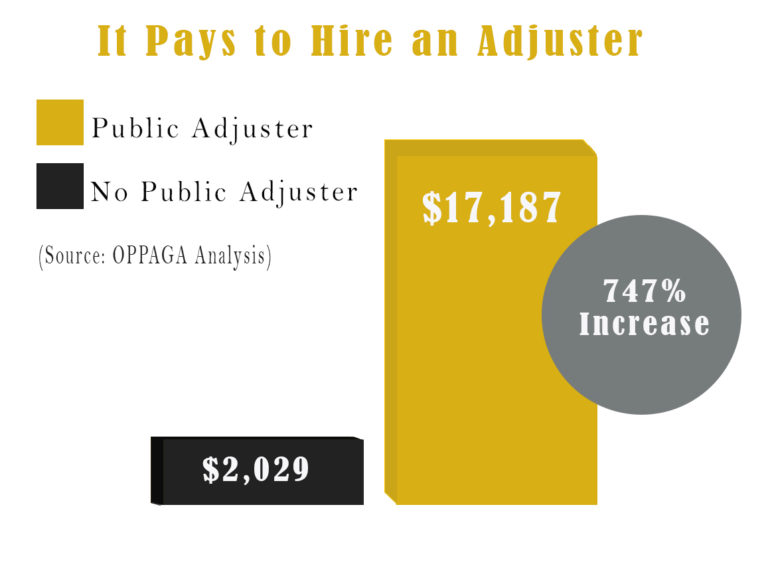

Many homeowners are unaware or skeptical about hiring a public adjuster, fearing additional costs or delays in the claims process. However, the benefits they bring to the table are invaluable. The pros of hiring an adjuster far outweigh the cons. A public adjuster will review your policy, assess the damage accurately, and negotiate with the insurance company on your behalf. They can often secure higher settlements, making their fees a worthwhile investment.

Tips for a Successful Claim

To increase your chances of a successful claim, proactive measures are essential. Maintain open communication with both your insurance company and your public adjuster if you’ve hired one. Keep meticulous records, including photographs, repair estimates, and correspondence related to the claim. These documents will serve as evidence of the damage and your efforts to mitigate it.

The Claim Settlement

The claim settlement process can be a daunting negotiation. Insurance adjusters may initially offer lower settlements than what is needed to fully repair the damage. This is where a public adjuster shines. They will meticulously review the insurance company’s offer, ensuring that it covers all necessary repairs and replacements. They can also assist in countering low-ball offers with well-reasoned arguments.

Conclusion and Final Thoughts

In conclusion, hailstorms pose a significant threat to your home’s roof, and understanding the damage they can cause is the first step in addressing this issue. Navigating the roof insurance claim process can be a complex and time-consuming endeavor, but it’s a crucial one. The involvement of a public adjuster can make all the difference in ensuring that you receive a fair settlement that adequately covers the cost of repairs.

Don’t let the aftermath of a hailstorm leave you feeling overwhelmed and under-compensated. Taking swift action to assess and document damage, filing an insurance claim, and enlisting the expertise of a public adjuster can help you weather the storm with your home and finances intact. By following the steps outlined in this article, you’ll be better equipped to face the challenges of hail damage and emerge with a restored roof and peace of mind.

Enlist the Largest, Best, Fully Staffed Public Adjuster Firm to Negotiate Your Roof Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

Thank you,

Montanna

If you have any damage it's worth it to call Noble to do the hard work for you...