Hiring a Public Adjuster vs. Hiring an Attorney: Making the Right Choice for Your Property Insurance Claim – Public Adjuster FAQs

Noble Public Adjusting Group always strives to use our blog to inform and educate property owners about all things involving insurance. In such situations, homeowners are often faced with a critical decisions. One of those major decisions is whether to hire a public adjuster or an attorney to help them through the claims process. Both professionals serve vital roles in managing property insurance claims, but they bring different skills and expertise to the table. In this article, we will explore the key differences between hiring a public adjuster and hiring an attorney. We make a strong argument for why using a public adjuster first is the best move in most cases.

Public Adjusters: Advocates for Policyholders

A public adjuster is a licensed professional who specializes in assessing and managing property insurance claims on behalf of policyholders. Public adjusters are insurance experts that play a crucial role in ensuring that individuals and businesses receive fair compensation for property damage or loss covered under their insurance policies. The following are some compelling reasons why hiring a public adjuster first is a wise choice:

Expertise in Property Insurance Policies: Public adjusters have an in-depth understanding of property insurance policies and the industry’s intricacies. They can decipher the complex language in policies and identify coverage options, exclusions, and limitations that might affect your claim.

Thorough Property Inspection and Damage Estimate: One of the most critical aspects of the claims process is assessing the extent of the damage. Public adjusters thoroughly inspect the property to document all damages, ensuring that nothing is overlooked, and the very critical property damage estimate. This attention to detail can significantly impact the claim’s outcome.

Negotiation Skills: Public adjusters excel at negotiating with insurance companies. They have the skills and experience needed to push for fair settlements on behalf of policyholders, ensuring that you receive the maximum compensation to which you are entitled.

Time and Stress Management: Handling a property insurance claim can be incredibly time-consuming and stressful, especially when you are dealing with property damage. Public adjusters take the burden off your shoulders by managing all aspects of the claim, allowing you to focus on rebuilding and recovery.

Objective is Aligned with Property Owner: Unlike attorneys, public adjusters are do not have a vested interest in prolonging or escalating the claim, as they are typically compensated based on a percentage of the settlement. This ensures that their assessments and recommendations are objective and aimed at maximizing your claim payout.

Attorneys: Legal Experts in Property Insurance Disputes

Attorneys are legal professionals who specialize in representing clients in various legal matters, including insurance disputes. While they can be a valuable resource in certain situations, there are several key factors to consider when deciding whether to hire an attorney for your property insurance claim:

Legal Expertise: Attorneys are trained in the intricacies of the law and can provide legal advice and representation if your claim leads to a lawsuit or legal dispute with the insurance company. This can be crucial if your claim is complex or involves disputes over liability.

Legal Action: If your property insurance claim is denied or you believe you are not receiving a fair settlement, an attorney can help you take legal action against the insurance company. They can file lawsuits and represent you in court, if necessary.

Contingency Fees: Many attorneys who handle insurance claims work on a contingency fee basis, meaning they only get paid if they win your case. However, attorney fees can be substantial, and they typically take a percentage of your settlement, reducing the amount you ultimately receive. A significant advantage in hiring a public adjuster is how public adjusters are paid, as it equates to a much lower overall fee.

Limited Property Assessment: While attorneys may have a basic understanding of property damage and insurance policies, their primary focus is on the legal aspects of your claim. They may not offer the same level of expertise in assessing the full extent of your damages.

The Strong Argument for Hiring a Public Adjuster First

Now that we’ve highlighted the roles and differences between public adjusters and attorneys, let’s make a strong argument for why hiring a public adjuster first may be the best choice for most insurance claimants.

Expertise in Claims Handling: Public adjusters specialize in the insurance claim process. They are seasoned professionals who understand the insurance industry’s nuances, policies, and procedures, making them well-equipped to navigate the complexities of a claim.

Objective Advocacy: Public adjusters act as impartial advocates for policyholders. They work solely in your best interest, striving to secure the highest settlement possible without any conflicts of interest.

Faster Resolution: Public adjusters can expedite the claims process by efficiently documenting and negotiating your property insurance claim. This can significantly reduce the time it takes to receive your settlement, helping you get back on your feet sooner.

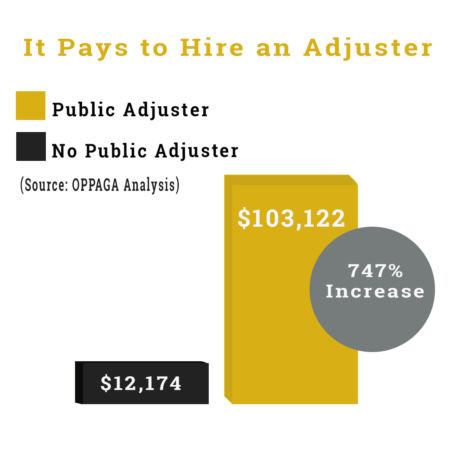

Maximized Insurance Payouts: By leveraging a PA’s negotiation skills and thorough property assessments, public adjusters often secure larger settlements than policyholders would obtain on their own. This increased compensation can be essential for covering repair or replacement costs.

Most Cost-Effective: Public adjusters typically work on a contingency fee basis, charging a percentage of the final settlement. While this fee may be a fraction of what you gain with their assistance, it’s generally more affordable than the rates charged by attorneys, fees which typically range from 30 to 40 percent, or even higher.

Reduced Stress: Dealing with property damage and insurance claims can be emotionally and mentally draining. Public adjusters handle all the claim-related tasks, allowing you to focus on your family, business, or personal recovery.

Often a Public Adjuster and an Attorney Are Needed to Settle a Claim

While public adjusters are often the preferred first choice for insurance claims, there are situations where it takes both, hiring a public adjuster first and bringing on an attorney later in the claims process to cross the finish line. The two most common reasons are:

- Legal Disputes: If your insurance claim has resulted in a legal dispute or lawsuit, hiring an attorney becomes essential. They will represent you in court and handle the legal aspects of your case. Sometimes it may take the accountability of the courtroom that finally gets the insurance company to make the right choice. Sadly, it is not uncommon to finally receive a fair settlement offer right before the case reaches the trial date.

- Bad Faith Claims: When an insurance company acts in bad faith by unreasonably denying or delaying your claim, an attorney can help you hold the insurer accountable for its actions.

Hiring a Public Adjuster First Allows Ability to Choose to Hire Attorney Later for Lower Overall Fees

By involving a public adjuster early in the claims process, policyholders can often resolve disputes and secure a fair settlement without resorting to legal action. This can lead to significant cost savings because attorney fees and the expenses associated with litigation can be substantial. Hiring a public adjuster first when dealing with property insurance claims is a strategic move that can help policyholders maximize their claim settlements and avoid unnecessary legal expenses.

Noble Public Adjusting Group has the expertise and reputation of negotiating and settling insurance claims on behalf of policyholders across the United States. We resolve disputes with the insurance company more efficiently, potentially reducing the need for legal representation. However, if the situation escalates and legal action becomes necessary, policyholders still have the option to hire an attorney to protect their interests. This approach is designed to achieve the best possible outcome for the policyholder while managing costs effectively.

Enlist the Largest & Best, Fully Staffed Public Adjuster Firm for Your Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

Watch Insurance Wars Season 1, Episode 3 “Explosion” from Our Hit Reality TV Show

Much of our work is prominently featured on our well-received and popular television program, “Insurance Wars”. This show was created with the primary objective of providing insight into the genuine conflicts that arise between insurance adjusters and public adjusters when they work on claims for our esteemed clients. “Insurance Wars” serves as a platform for our clients to share their personal experiences, recounting the tumultuous situations that arise when their lives are disrupted by natural disasters, leaving them in urgent need of guidance and support.

Through “Insurance Wars,” we aim to dispel common misconceptions surrounding public adjusters by highlighting the extensive expertise and knowledge that our team members bring to the table.