Noble Public Adjusting Group Extending Exceptional Public Adjuster Services to South Carolina and North Carolina

FOR IMMEDIATE RELEASE

[Raleigh, North Carolina, March 26, 2024] Noble Public Adjusting Group, a renowned leader in the field of insurance advocacy, proudly announces its expansion into the dynamic state of North Carolina. With a proven history of success in countless other states, Noble Public Adjusting Group is now extending its expert services as the best North Carolina public adjuster to residents across key metropolitan areas in the state, including Charlotte, Raleigh, Greensboro, and Durham.

North Carolina Policyholders Need Advocacy

In recent years, North Carolina has experienced a series of newsworthy weather events, ranging from hurricanes and tropical storms to severe thunderstorms and flooding. These include Hurricane Florence in 2018, which caused extensive flooding and property damage across the state, as well as Hurricane Dorian in 2019, which also left a trail of destruction in its wake. Additionally, North Carolina has been susceptible to tornado outbreaks and winter storms, all of which have resulted in significant property damage for homeowners and businesses alike.

In the aftermath of such tragic events, it becomes crucial for home and business owners to have access to an excellent public adjusting firm like Noble. Public adjusters play a vital role in helping clients navigate the complex process of filing insurance claims and maximizing their settlements. With their expertise and advocacy, public adjusters ensure that clients receive the compensation they rightfully deserve, allowing them to rebuild and recover from the devastation caused by natural disasters. Hiring the best North Carolina public adjuster can help policyholders receive the best possible settlement.

North Carolina Public Adjusters: Help Your Fellow Citizens And Enjoy a Lucrative Career

What Is A North Carolina Public Adjuster And What Does a PA Do?

So, what exactly is the role of a public adjuster in North Carolina? A licensed insurance claim expert, a public adjuster acts as a staunch advocate for policyholders. Their primary task involves negotiating equitable settlements with insurance companies, making them pivotal figures in resolving disputes. Within the realm of property insurance, unexpected disasters or mishaps can trigger intricate and intimidating claims processes. This is where public adjusters truly shine in North Carolina. Serving as a beacon of support, North Carolina public adjusters guide policyholders through the maze of insurance claims with a blend of expertise and compassion, ensuring they receive the fair treatment they deserve.

Steps To Becoming A Public Adjuster in North Carolina

To become a public adjuster in North Carolina, individuals must follow a set of steps and adhere to specific rules and regulations set forth by the North Carolina Department of Insurance.

To become a public adjuster in North Carolina, individuals must follow specific steps and meet certain requirements set by the state. These steps include:

- Meet Eligibility Requirements: Ensure you meet the minimum eligibility criteria set by the North Carolina Department of Insurance, including age requirements and background checks.

- Complete Pre-Licensing Education: Enroll in and successfully complete state-approved pre-licensing education courses specific to public adjusting. These courses cover essential topics such as insurance laws, regulations, and claims handling procedures.

- Pass the State Licensing Exam: Prepare for and pass the North Carolina state licensing exam for public adjusters. The exam assesses your knowledge of insurance laws, ethics, and claims adjusting practices.

- Submit Licensure Application: After passing the exam, submit a licensure application to the North Carolina Department of Insurance. Ensure all required documentation, including education certificates and background information, is included with your application.

- Obtain a Surety Bond: Secure a surety bond as required by the state. This bond serves as financial protection for policyholders and ensures compliance with state regulations.

- Fulfill Additional Requirements: Depending on North Carolina regulations, you may need to fulfill additional requirements such as undergoing fingerprinting or completing continuing education courses to maintain your license.

- Start Your Career: Once licensed, you can embark on your career as a public adjuster in North Carolina. Consider joining an established firm like Noble Public Adjusting Group to gain experience and support as you begin representing policyholders and advocating for fair settlements.

By following these specific steps, you can become a licensed public adjuster in North Carolina and start assisting policyholders with their insurance claims. It’s important to note that licensing requirements and procedures may vary and change over time.

Average Public Adjusters (PAs) in North Carolina Make $40,000 to $80,000 Annually

In North Carolina, public adjusters have the potential to earn a lucrative income. The average salary for a public adjuster in North Carolina can vary based on factors such as experience, location, and the volume of claims handled. Generally, public adjusters in North Carolina can earn anywhere from $40,000 to $80,000 or more annually, depending on these factors. Experienced adjusters with a strong client base and a track record of successful settlements tend to earn higher salaries. Additionally, public adjusters who work for established firms like Noble may command higher incomes, up to six figures. By joining Noble Public Adjusting Group, individuals can benefit from competitive compensation packages, ongoing training and support, and the opportunity to make a tangible difference in people’s lives.

Expanding Across North Carolina: Advocacy in All the Key Cities

As Noble Public Adjusting Group extends its reach into North Carolina, the firm is poised to advocate for policyholders across a spectrum of cities, ensuring that residents throughout the state receive the expert assistance they deserve. In addition to major metropolitan areas like Charlotte, Raleigh, Greensboro, Durham, and Winston-Salem, Noble will also be active in advocating for clients in other significant cities across North Carolina, including Wilmington, Asheville, Fayetteville, and Greenville. With a commitment to serving communities large and small, Noble is dedicated to providing top-tier advocacy services to policyholders statewide, empowering them to navigate the complexities of insurance claims with confidence and peace of mind.

Join Noble in The Insurance War in North Carolina

Joining Noble Public Adjusting Group presents a promising opportunity for individuals seeking a rewarding career in North Carolina. With the state’s susceptibility to natural disasters, the demand for skilled public adjusters is high. By becoming part of Noble’s team, individuals can benefit from competitive compensation packages, ongoing training, and the chance to make a tangible difference in people’s lives. With a focus on professionalism, integrity, and client advocacy, Noble provides a supportive environment where public adjusters can thrive and build a successful career in insurance advocacy.

Apply Now!

Do you feel that you are the right fit for the Noble team? Fill out the form below accurately indicating your potential and suitability for the job you’re applying for. Please submit every portion you can, including the resume, photo, and cover letter upload option.

FOR IMMEDIATE RELEASE

[Columbia, South Carolina, March 26, 2024] Noble Public Adjusting Group, a highly respected leader in insurance advocacy, proudly announces its expansion into the vibrant state of South Carolina. With a history of success in numerous states, Noble Public Adjusting Group is now extending its expert services as the premier South Carolina public adjuster to residents across key metropolitan areas in the state, including Charleston, Columbia, Greenville, Myrtle Beach, and Spartanburg.

South Carolina Policyholders Need Help Fighting Big Insurance

In recent years, South Carolina, just like its neighbor to the north, South Carolina has encountered a series of impactful weather occurrences, including hurricanes, tropical storms, severe thunderstorms, and flooding. Notable examples include Hurricane Florence in 2018, which led to widespread flooding and property damage statewide, and Hurricane Dorian in 2019, leaving a trail of destruction. Additionally, the state has faced tornado outbreaks and winter storms, contributing to significant property damage for residents and businesses alike.

Following such devastating events, it becomes imperative for homeowners and business proprietors to have access to a reputable public adjusting firm such as Noble. Public adjusters play a pivotal role in guiding clients through the intricate process of filing insurance claims and optimizing their settlements. Leveraging their expertise and advocacy, public adjusters ensure that clients receive fair compensation, facilitating their recovery and rebuilding efforts post-disaster. Engaging the services of the finest public adjuster in South Carolina can greatly enhance policyholders’ chances of securing an optimal settlement. Hiring the best South Carolina public adjuster can help policyholders receive the best possible settlement.

South Carolina Public Adjusters: Support Your Community and Thrive in a Rewarding Profession

What Is A South Carolina Public Adjuster And What Does a PA Do?

What exactly does a public adjuster do in South Carolina? As licensed insurance claim experts, public adjusters act as strong advocates for policyholders. Their main responsibility revolves around negotiating equitable settlements with insurance companies, making them crucial players in dispute resolution. In the realm of property insurance, unexpected disasters or mishaps can lead to complex and daunting claims processes. This is where public adjusters shine in South Carolina. Serving as pillars of support, they navigate policyholders through the intricacies of insurance claims with a combination of expertise and compassion, guaranteeing they are treated fairly.

Steps To Becoming A Public Adjuster in South Carolina

To become a public adjuster in South Carolina, individuals must adhere to specific steps and meet requirements established by the South Carolina Department of Insurance.

Meet Eligibility Requirements: Ensure compliance with the minimum eligibility criteria set by the South Carolina Department of Insurance, including age and background check prerequisites.

Complete Pre-Licensing Education: Enroll in and successfully complete state-approved pre-licensing education courses tailored to public adjusting. These courses cover essential topics such as insurance laws, regulations, and claims handling procedures.

Pass the State Licensing Exam: Prepare for and pass the South Carolina state licensing exam designed for public adjusters. This exam evaluates your understanding of insurance laws, ethics, and claims adjusting practices.

Submit Licensure Application: Upon passing the exam, submit a licensure application to the South Carolina Department of Insurance. Ensure all necessary documentation, including education certificates and background information, is included with your application.

Obtain a Surety Bond: Secure a surety bond as mandated by state regulations. This bond provides financial protection for policyholders and ensures adherence to state requirements.

Fulfill Additional Requirements: Depending on South Carolina regulations, you may need to fulfill additional requirements such as undergoing fingerprinting or completing continuing education courses to maintain your license.

Start Your Career: Once licensed, you can commence your career as a public adjuster in South Carolina. Consider affiliating with a reputable firm like Noble Public Adjusting Group to gain experience and support as you advocate for policyholders and strive for fair settlements.

By following these specific steps, you can obtain licensure as a public adjuster in South Carolina and begin assisting policyholders with their insurance claims. It’s crucial to stay updated on licensing requirements, as they may vary and evolve over time.

Public Adjusters (PAs) in South Carolina Typically Earn Annual Salaries Ranging from $40,000 to $80,000

In South Carolina, public adjusters have the potential to achieve significant earnings. Salaries for public adjusters in South Carolina vary depending on factors such as experience, location, and the number of claims handled. On average, public adjusters in South Carolina earn between $40,000 and $80,000 annually, with experienced adjusters and those with a strong track record often earning higher salaries. Working for established firms like Noble Public Adjusting Group can further increase income potential, with some public adjusters earning up to six figures. Joining Noble provides individuals with competitive compensation packages, ongoing training, and the chance to positively impact the lives of others.

Expanding Across South Carolina: Advocacy in Major Cities

As Noble Public Adjusting Group expands its presence in South Carolina, the company is ready to champion for policyholders in various cities, ensuring that residents statewide receive the expert assistance they deserve. In addition to major urban centers like Charleston, Columbia, Greenville, Myrtle Beach, and Spartanburg, Noble will actively advocate for clients in other significant cities across South Carolina, including Hilton Head Island, Florence, Rock Hill, and Sumter. With a steadfast commitment to serving communities of all sizes, Noble is devoted to delivering top-notch advocacy services to policyholders across the state, empowering them to navigate insurance claim complexities with assurance and tranquility.

Join Noble in Advocating for Policyholders in South Carolina’s Insurance War

Becoming a part of Noble Public Adjusting Group offers a promising career path for individuals in South Carolina. Given the state’s vulnerability to natural calamities, there’s a high demand for proficient public adjusters. Joining Noble’s team provides individuals with competitive compensation, continuous training, and the opportunity to significantly impact others’ lives. Noble emphasizes professionalism, integrity, and client advocacy, fostering a supportive environment where public adjusters can flourish and establish a prosperous career in insurance advocacy.

Become A Public Adjuster in North Carolina and South Carolina and Make A Big Impact On Your Community

Noble Public Adjusting Group invites individuals who share its commitment to justice and advocacy to join the fight against big insurance. Together, we can level the playing field and ensure that policyholders are treated fairly and with respect. By expanding its operations into Colorado, Noble Public Adjusting Group aims to provide support and guidance to communities across the state, from bustling urban centers to serene mountain towns.

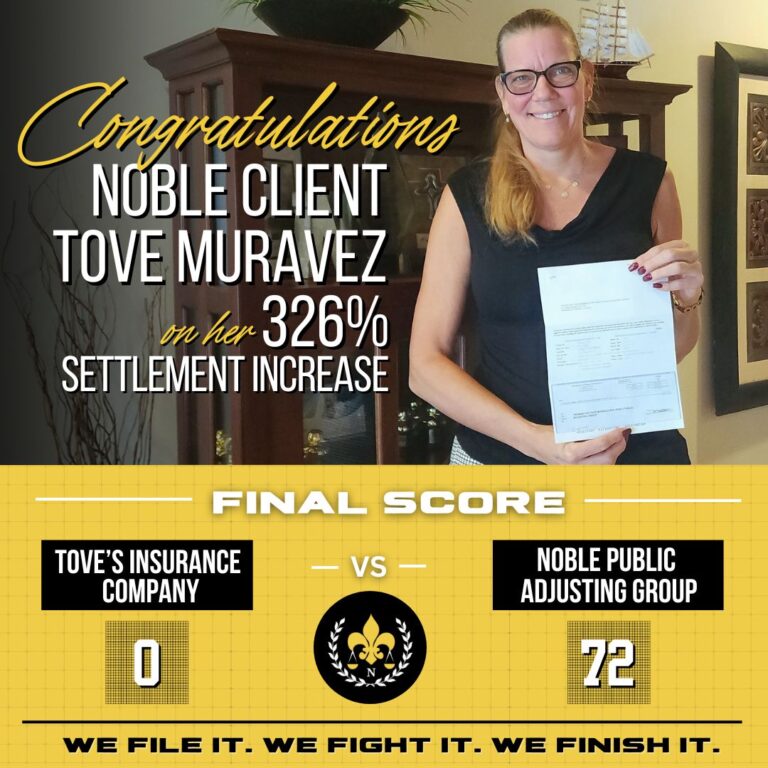

A Legacy of Unrivaled Excellence: Noble Public Adjusting Group

For over a decade, Noble Public Adjusting Group has reigned supreme as the pinnacle of the insurance advocacy realm. With an illustrious history marked by unparalleled success, Noble stands as the undisputed leader in the United States’ public adjusting landscape. Renowned for its meticulous attention to detail and unwavering dedication to client satisfaction, Noble has consistently delivered extraordinary outcomes, securing substantial settlements for policyholders nationwide. As the largest and most esteemed public adjusting firm in the USA, Noble’s sterling reputation and distinguished track record set it apart as the unequivocal choice for discerning home and business owners seeking elite representation for their insurance claims.

Elite Public Adjusting Services for Home and Business Owners

In conclusion, home and business owners in North Carolina can trust Noble Public Adjusting Group to provide expert assistance in navigating the complexities of insurance claims. With a proven track record of success and a commitment to client satisfaction, Noble ensures that policyholders receive the compensation they rightfully deserve. From assessing property damage to negotiating with insurance companies, Noble’s team of experienced adjusters is dedicated to achieving the best possible outcome for clients. By choosing Noble, individuals can rest assured that their interests are represented with professionalism and expertise, allowing them to rebuild and recover from the devastation of natural disasters.

Join Our Noble Team By Applying Now!

Are you feeling inspired and feel that you might be a fit for the Noble team? Fill out the form below. Please accurately indicate your potential and suitability for the position. Please submit each portion you can, including the resume, photo, and cover letter upload option.

Watch “Insurance Wars – Above The Floodline”. A Hurricane Insurance Claim Episode from Our Hit Reality TV Show

Much of our work is prominently featured on our well-received and popular television program, “Insurance Wars”. This show was created with the primary objective of providing insight into the genuine conflicts that arise between insurance adjusters and public adjusters when they work on claims for our esteemed clients. “Insurance Wars” serves as a platform for our clients to share their personal experiences, recounting the tumultuous situations that arise when their lives are disrupted by natural disasters, leaving them in urgent need of guidance and support.

Through “Insurance Wars,” we aim to dispel common misconceptions surrounding public adjusters by highlighting the extensive expertise and knowledge that our team members bring to the table.

Join the Largest & Best, Fully Staffed Public Adjuster Firm in the United States!

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

Related Posts

The Pros and Cons of Using a Public Adjuster