Filing a Homeowners Insurance Claim for Roof Damage: Why Hiring a Public Adjuster Makes Sense

Your home is your sanctuary, the place where you and your family find shelter and security. It’s also one of your most significant investments, and protecting it is a top priority. Unfortunately, your home’s roof is susceptible to various types of damage, such as hail, wind, and storm damage. When disaster strikes, your homeowners insurance policy is there to provide the much-needed financial relief. However, navigating the insurance claims process can be complex and daunting. This is where a public adjuster can be a tactical advantage in ensuring that your insurance company pays what’s owed based on the insurance policy contract.

Common Types of Roof Damage

Before delving into the role of a public adjuster, it’s important to understand the most common types of roof damage that homeowners face.

1. Hail Damage: Hailstorms can wreak havoc on your roof. Hailstones, ranging in size from tiny pellets to golf ball-sized projectiles, can dent, crack, or even puncture your roof’s shingles. Hail storm damage can lead to leaks, which, if not promptly addressed, can result in more extensive and costly repairs. Identifying hail damage isn’t always straightforward, but a trained eye can spot telltale signs such as dents on your gutters, downspouts, or soft metal roof components.

2. Wind Damage: Strong winds can peel off roofing materials, leaving your home vulnerable to water infiltration and further damage. Missing shingles or roof tiles can be a clear indication of wind damage and more often than not, the shingle damage calls for a new roof rather than a roof repair. The problem is though, shingle damage caused by wind may not always be visible from the ground, making a professional inspection essential to identify less obvious issues.

3. Storm Damage: Severe storms, including thunderstorms and hurricanes, can cause significant damage to your roof. Heavy rainfall, flying debris, and high winds can lead to roof leaks, structural damage, and in extreme cases, complete roof failure. Often, storm damage is accompanied by other property damage, such as fallen trees or damaged windows, implicating the claims process.

Noteworthy: Top 10 States with Most Wind and/or Hail Claims

– Texas

– Illinois

– New York

– Ohio

– Missouri

– Tennessee

– Indiana

– New Jersey

– Kentucky

– Colorado

Why a Public Adjuster Matters

Filing a homeowners insurance claim for roof damage can be a complex and time-consuming process, fraught with challenges. Insurance companies have a vested interest in minimizing their payouts, and this is where a public adjuster can be your strongest ally. For anyone asking questions such as, “will my insurance pay for my roof replacement?” or “how long do I have to file a claim?” you should consider consulting with one of our public adjusters. Here are some reasons why hiring a public adjuster is tactically advantageous:

1. Expertise: Public adjusters are trained and experienced insurance professionals in assessing and documenting property damage. Public adjusters understand the nuances of insurance policies, coverage, and the claims process. This expertise can make a significant difference in ensuring you receive the compensation you deserve.

2. Objective Assessment: Unlike insurance company adjusters, who work for the insurer, public adjusters work for you, the policyholder. They provide an objective assessment of the damage and its cost, ensuring you’re not shortchanged by your insurance company.

3. Comprehensive Documentation: One of the key factors in a successful insurance claim is comprehensive documentation of the damage. Public adjusters excel in this area, meticulously cataloging the extent of roof damage, including hidden or less obvious issues. Their documentation can strengthen your claim and increase the likelihood of a fair settlement.

4. Negotiation Skills: Public adjusters are skilled negotiators. They can engage with your insurance company’s adjuster on your behalf, advocating for your best interests and maximizing your payout. Their ability to negotiate can lead to a more favorable resolution of your claim.

5. Faster Resolution: With a reputable public adjuster guiding your claim, the process is typically faster and more efficient. They know the ins and outs of the claims process and can help expedite the assessment, negotiation, and settlement stages.

6. Reduced Stress: Dealing with a damaged roof is stressful enough. Handling the insurance claim process on top of that can be overwhelming. A public adjuster takes much of the burden off your shoulders, allowing you to focus on repairing your home and getting your life back to normal.

7. Maximizing Compensation: Ultimately, the goal of hiring a public adjuster is to maximize the payout on your insurance settlement by what your insurance policy entitles you to. Public adjusters are well-versed in the intricacies of insurance policies and can ensure you receive the full amount you’re entitled to under your policy.

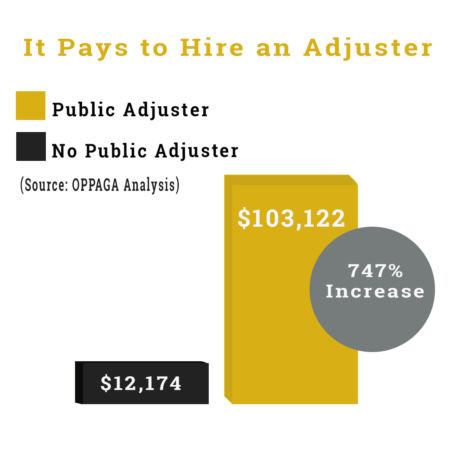

It Pays to Hire a Reputable Public Adjuster on Roof Insurance Claim

Filing a homeowners insurance claim for roof damage is a crucial step in safeguarding your home and investment. Hail, wind, and storm damage are common threats that can result in significant repair costs. Hiring Noble Public Adjusting Group in such situations can be a tactical advantage. Their expertise, objectivity, comprehensive documentation, negotiation skills, and ability to expedite the claims process can make a substantial difference in ensuring that your insurance company pays what’s actually owed based on the insurance policy contract. In times of distress, having a professional by your side to navigate the insurance claims process can provide you with peace of mind and the financial relief you need to restore your home.

Enlist the Largest, Best, Fully Staffed Public Adjuster Firm to Negotiate Your Roof Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione