When is it Too Late to Hire a Public Adjuster? Answer: It’s Not Too Late.

As a property owner, navigating the complex world of insurance claims can be a daunting task, especially when dealing with damage from unexpected events like natural disasters, fires, or accidents. Insurance policies are meant to provide financial protection during these challenging times, but the process of filing a claim and ensuring you receive a fair settlement can be overwhelming. This is where a public adjuster can come to your rescue. But when is it too late to hire a public adjuster? The answer is simple: it’s never too late as long as the property owner hasn’t signed a final release.

The Role of a Public Adjuster

Before delving into the question of timing, it’s essential to understand what a public adjuster does. A public adjuster is a licensed professional who advocates on behalf of the policyholder during the insurance claims process. Their primary role is to ensure that the policyholder receives the maximum possible settlement to cover their losses. Public adjusters are experts in insurance policies, claims processes, and damage assessment. They work independently and are not affiliated with insurance companies, which means their loyalty lies solely with the property owner.

The Timing of Hiring a Public Adjuster

Many property owners are unaware of the services provided by public adjusters until after they’ve initiated the insurance claims process on their own. It’s a common misconception that you must hire a public adjuster right from the start. However, this is not the case. You can bring a public adjuster into the process at almost any point, as long as you haven’t signed a release from your insurance company.

Before You File a Claim

Hiring a public adjuster before you even file a claim can be a strategic move. They can help you understand the intricacies of your insurance policy, assess the damage, and ensure that you document everything necessary for a successful claim. Their expertise can prevent potential pitfalls and ensure that your claim is off to a solid start.

During the Claims Process

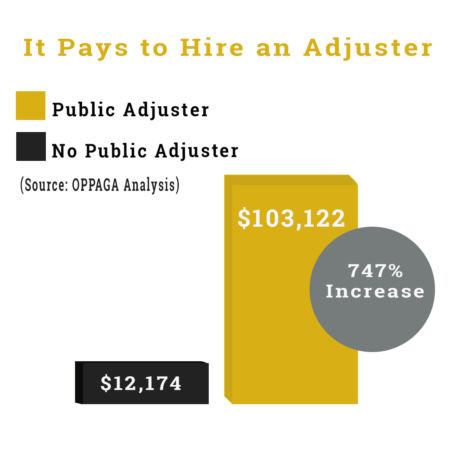

It’s quite common for property owners to start the claims process on their own and then encounter difficulties in reaching a satisfactory settlement. At this point, you can hire a public adjuster to step in and take over the negotiations with the insurance company. Public adjusters are skilled at negotiating and can often secure a higher payout than what the property owner might achieve alone.

When a Claim is Denied

If your claim is denied, it’s not the end of the road. Many property owners believe that once their claim is denied, they have no recourse. This is not true. A public adjuster can assess the denial and work to appeal it. They will review the denial letter, gather additional evidence, and present a strong case to the insurance company to have the decision reversed.

When You’re Unsatisfied with the Settlement

Even if you’ve received a settlement offer, it might not be enough to cover the full extent of your losses. In fact, typically the property owners often discover later that the initial offer to settle their insurance claim was underpaid, as it doesn’t account for all the damage and expenses in reality. Hiring a public adjuster at this stage can help you negotiate for a more reasonable and comprehensive settlement.

Benefits of Hiring a Public Adjuster

Now that we’ve established that it’s never too late to hire a public adjuster as long as you haven’t signed a release, let’s delve into the advantages of enlisting their services:

Expertise and Knowledge

Public adjusters are well-versed in insurance policies and claims processes. They understand the nuances of different policies and know how to maximize your claim. Their knowledge can be the difference between a minimal payout and a settlement that truly covers your losses.

Effective Negotiation

Insurance companies often use experienced adjusters to protect their interests. Hiring a public adjuster levels the playing field, as they are equally skilled in negotiation. Public adjusters advocate for your rights and ensure you are not taken advantage of during the settlement process.

Accurate Damage Assessment

One of the key roles of a public adjuster is to assess the extent of the damage accurately. They have the skills and experience to identify damage that may not be immediately visible, ensuring that you receive compensation for all losses.

Save Time and Reduce Stress

Dealing with insurance claims can be time-consuming and stressful. Public adjusters take the burden off your shoulders, allowing you to focus on getting your life back on track while they handle the intricacies of the claims process.

If You Didn’t Sign a Final Release – Noble Can Still Help with Your Insurance Claim

In conclusion, the question of when it’s too late to hire a public adjuster comes down to a simple answer: it’s never too late as long as the property owner hasn’t signed a release. Whether you’re just beginning the claims process, facing a claim denial, or unsatisfied with the initial settlement offer, a public adjuster can step in and be your advocate. Their expertise, negotiation skills, and ability to accurately assess damage make them a valuable asset in maximizing your insurance claim. Remember, your insurance policy is meant to provide you with financial protection, and hiring a public adjuster ensures that you receive the full benefit of that protection. Don’t hesitate to seek their assistance when navigating the complex world of insurance claims.

Watch “Insurance Wars – Fiery Debate”. A Fire Insurance Claim Episode from Our Hit Reality TV Show

Much of our work is prominently featured on our well-received and popular television program, “Insurance Wars”. This show was created with the primary objective of providing insight into the genuine conflicts that arise between insurance adjusters and public adjusters when they work on claims for our esteemed clients. “Insurance Wars” serves as a platform for our clients to share their personal experiences, recounting the tumultuous situations that arise when their lives are disrupted by natural disasters, leaving them in urgent need of guidance and support.

Through “Insurance Wars,” we aim to dispel common misconceptions surrounding public adjusters by highlighting the extensive expertise and knowledge that our team members bring to the table.

Enlist the Largest, Best, Fully Staffed Public Adjuster Firm to Negotiate Your Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione