Hard Truth About Property Insurance Companies People Find Out the Hard Way – Public Adjusters are the Equalizers in the Insurance Claim Settlement Fight

Property insurance is meant to provide security and peace of mind when disaster strikes, whether it be due to a fire, storm, theft, or any other unfortunate event. Homeowners and property owners rely on these policies, paying their premiums with the expectation of support in times of crisis. However, there’s a hard truth about property insurance claims that many individuals only discover when they’re already entrenched in a battle to secure the compensation they deserve. In this article, we’ll delve into the hidden complexities of property insurance claims, the tactics used by insurance companies, and the crucial role of a public adjuster in ensuring a fair resolution.

You’re in a Fight, But You Don’t Know It

The first hard truth about property insurance companies is that policyholders often find themselves in a battle without realizing it. The claims process may appear straightforward at first glance: file a claim, provide documentation, and receive the compensation you need to rebuild or replace your property. There have been billions of advertising dollars spent to curate that “on your side” impression. However, behind the scenes, insurance companies often employ tactics to minimize payouts. This battle begins the moment you file a property insurance claim, and many policyholders are typically ill-prepared for the fight that follows.

Property insurance companies have a financial incentive to pay as little as possible on claims. While they’ll gladly collect premiums, they are just as eager to not give it back, which is why they deploy teams of adjusters, lawyers, and investigators to scrutinize every detail of your claim. There is a systematic playbook on doing just that. Their personnel are trained and tasked with finding ways to deny or reduce payouts. Policyholders, on the other hand, are typically untrained and ill-equipped to navigate this complex process on their own.

Billions of Dollars Invested to Pay Property Owners as Little as Possible

The unsettling reality about insurance companies and their practices is well-documented in the book “Delay, Deny, Defend” by Jay Feinman. It exposes the systematic approach used by insurance companies to delay, deny, and defend against paying out a fair settlement, particularly in property insurance cases.

It reveals that insurers invest billions of dollars in strategies designed to pay property owners as little as possible. These strategies include:

- Delaying Tactics: Property insurance companies employ various tactics to delay the processing of claims. Delays can range from requesting extensive documentation to causing frustration and exhaustion among policyholders.

- Denial Strategies: Insurers actively seek reasons to deny property insurance claims, sometimes using vague policy language to reject valid requests. They rely on the assumption that property owners won’t have the legal knowledge or resources to challenge these denials.

- Defensive Maneuvers: Insurance companies are known to vigorously defend their positions when property insurance claims are challenged, often leading to lengthy legal battles.

Documented Legal Cases as Examples

To better understand the tactics employed by property insurance companies and the outcomes of these strategies, it’s crucial to examine documented legal cases. These examples serve as stark reminders of the challenges property owners face when filing claims.

Case 1: The Johnsons’ Home Fire

The Johnson family filed a property insurance claim after their home was severely damaged by a fire. Despite having comprehensive coverage, the insurance company initially denied their claim, citing an obscure exclusion. The Johnsons hired a lawyer and, after a prolonged legal battle, eventually received only a fraction of the amount they were entitled to. The delay, deny, defend strategy played out in this case, causing substantial stress and financial burden for the family.

Case 2: Rita’s Storm-Damaged Property

Rita’s beachfront property was devastated by a hurricane. Her property insurance company refused to cover certain damages, citing ambiguities in the policy. Rita’s fight for fair coverage involved hiring a legal team, which eventually secured the compensation she deserved. The delay and denial tactics of the insurer delayed her ability to rebuild her property, causing additional emotional and financial strain.

Why Public Adjusters are Your First Line of Defense

Given the significant imbalance of power in property insurance claim disputes, hiring a public adjuster is of paramount importance to level the playing field. Public adjusters are licensed professionals who work on behalf of property owners, not insurance companies. They possess a deep understanding of property insurance policies and the claims process, enabling them to negotiate fair settlements.

Public Adjusters Are On YOUR Side and Can:

- Assess the true value of your property insurance claim.

- Navigate the complex paperwork and documentation requirements.

- Advocate for your interests during negotiations.

- Handle communication with the insurance company, reducing your stress.

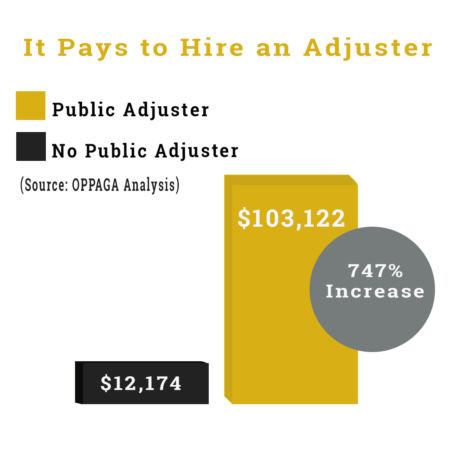

While public adjusters charge a fee for their services, the increase in the final settlement amount often offsets these costs. Property owners who enlist their help are more likely to receive fair compensation, avoid delays, and sidestep the tactics used by property insurance companies to reduce payouts.

Don’t Settle Your Insurance Claim for Less Than Your Owed

Now that we’ve pulled the curtain back a bit on some of the insurance companies’ tactics, property owners can be better equipped when they find themselves in a battle against insurance companies that are determined to minimize payouts. People can easily identify when faced with the systematic delay, deny, defend tactics used by insurers, as outlined in “Delay, Deny, Defend” by Jay Feinman, leave many individuals struggling to secure the coverage they rightfully deserve. By understanding the challenges they may face and the importance of hiring a public adjuster, property owners can improve their chances of a fair and equitable resolution to their property insurance claims. In a system where insurers wield significant power, seeking professional assistance can help level the playing field and ensure that justice is served. No matter where your property is located in the Unites States, Noble can assist you in winning the fight!

Enlist the Largest & Best, Fully Staffed Public Adjuster Firm for Your Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

Watch “Insurance Wars – Fiery Debate”. A Fire Insurance Claim Episode from Our Hit Reality TV Show

Much of our work is prominently featured on our well-received and popular television program, “Insurance Wars”. This show was created with the primary objective of providing insight into the genuine conflicts that arise between insurance adjusters and public adjusters when they work on claims for our esteemed clients. “Insurance Wars” serves as a platform for our clients to share their personal experiences, recounting the tumultuous situations that arise when their lives are disrupted by natural disasters, leaving them in urgent need of guidance and support.

Through “Insurance Wars,” we aim to dispel common misconceptions surrounding public adjusters by highlighting the extensive expertise and knowledge that our team members bring to the table.