What Home Insurance Adjusters Won’t Tell You

Home insurance is a vital safeguard for homeowners, providing peace of mind in times of crisis. When disaster strikes, you expect your insurance company to step in and help you recover. However, what many homeowners may not realize is that home insurance adjusters, who play a crucial role in the claims process, don’t always disclose everything you need to know. In this blog post, we’ll dive into the world of home insurance adjusters and uncover some of the secrets they may not be eager to share and why public adjusters are typically your best insurance claim counter-punch to even the fight.

The Claims Process Isn’t Always Smooth

Many homeowners believe that filing a claim is a straightforward process: you submit a claim, the adjuster assesses the damage, and you receive a fair settlement. While this is the ideal scenario, the reality can be far from it. Insurance adjusters may only sometimes disclose the potential obstacles you could face during the claims process.

One hidden truth is that insurance companies often aim to minimize their payouts. Adjusters may downplay the extent of the damage, offer lowball settlements, or employ various tactics to delay the claim settlement process. To navigate this challenge, homeowners must be prepared, well-documented, and persistent in advocating for their rights.

The Scope of Coverage Isn’t Always Clear

Another aspect that insurance adjusters may not fully clarify is the scope of your coverage. Home insurance policies can be complex and filled with jargon, making it challenging for homeowners to understand what is covered and what is not. Adjusters may only sometimes take the time to explain the fine print or offer guidance on how to maximize your coverage.

It’s crucial for homeowners to thoroughly review their policy and ask questions if they’re unsure about any aspect of it. A reputable public adjuster will usually be your best first line of defense in what ends up as an unfair fight due to the complexity of the claim process. There’s a good reason we have our TV show called Insurance Wars.

Documenting Your Loss Is Vital

Insurance adjusters may not emphasize the importance of documenting your losses adequately. Whether it’s due to a natural disaster, fire, theft, or any other covered event, keeping a meticulous record of your losses is essential. This documentation includes photographs, receipts, appraisals, and any other evidence proving the value of your damaged or stolen property.

With proper documentation, it becomes easier to substantiate your claim and receive a fair settlement. Insurance adjusters may not remind you of the critical role this documentation plays in the claims process, so it’s up to you to be proactive.

You Can Dispute Their Findings

Many homeowners are unaware that they have the right to dispute the findings and decisions of their insurance adjuster. If you believe that the adjuster’s assessment is inaccurate or unfair, you can challenge it. Insurance companies have a process for addressing disputes, which may involve a reevaluation of your claim by a different adjuster or arbitration.

Don’t hesitate to speak up and assert your rights if you feel that your claim is being mishandled. Insurance adjusters may not readily inform you of this option, but it can be crucial in ensuring a fair outcome.

Your Claim History Matters

Your claim history plays a significant role in your relationship with your insurance company. While adjusters may not explicitly mention it, frequent claims can lead to higher premiums or even policy cancellations. Insurance companies are in the business of managing risk, and homeowners with a history of numerous claims are seen as higher risks.

Before filing a claim, it’s essential to consider the potential long-term consequences on your policy and premiums. In some cases, it might be more cost-effective to cover smaller losses out of pocket to avoid future rate increases.

Public Adjusters Are Your True Ally on YOUR Side

Insurance adjusters from your insurance company may not disclose the option of hiring a public adjuster, but it’s a valuable resource that homeowners can consider. Public adjusters work independently from insurance companies and represent the homeowner’s interests in the claims process.

These professionals have the expertise to assess the extent of damage, negotiate with insurance companies, and help you receive a more favorable settlement. While public adjusters charge a fee for their services, they often more than pay for themselves by securing higher payouts than homeowners would have obtained on their own.

Your Insurance Company May Not Always Be on Your Side

It’s crucial to remember that insurance adjusters work for the insurance company, not for you. While they may appear helpful and sympathetic, their primary duty is to minimize the company’s financial liability. They may not always have your best interests at heart.

As a homeowner, it’s essential to remain vigilant and advocate for your rights throughout the claims process. Always seek independent advice when necessary, and feel free to push back if you think you’re not receiving fair treatment.

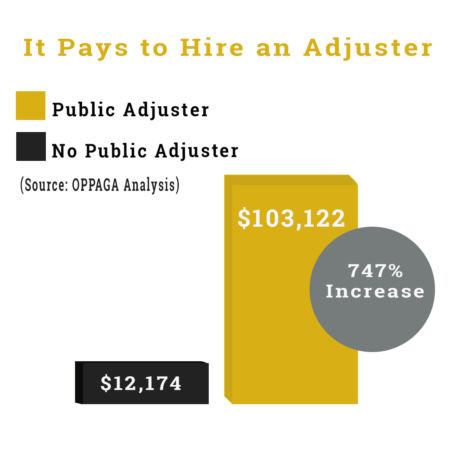

It Typically Pays to Hire a Public Adjuster

To ensure a fair and successful insurance claim, it’s crucial to document your losses and be prepared for potential disputes. When in doubt, enlist the assistance of a public adjuster to get the best possible settlement outcome.

Enlist the Largest, Best, Fully Staffed Public Adjuster Firm to Negotiate Your Insurance Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione