Public Adjuster vs. Insurance Adjuster: Leveling the Playing Field in Property Insurance Claims and Who Actually Represents Your Interests?

Property insurance is a crucial safeguard that protects homeowners and property owners from financial devastation when unforeseen disasters strike. Whether it’s damage caused by natural disasters, accidents, or other unexpected events, property insurance is designed to provide financial assistance for repairing or replacing damaged property. However, navigating the maze that is property insurance claims can be a daunting task, especially when dealing with insurance adjusters. In this article, we will explore the key differences between public adjusters and insurance adjusters, emphasizing the importance of hiring a public adjuster to represent your interests when making a property insurance claim.

The Role of Insurance Adjusters

First, let’s discuss insurance adjusters, often referred to as company adjusters or independent adjusters, are individuals employed or contracted by insurance companies to assess the validity and value of property insurance claims. While they are supposed to be neutral parties responsible for evaluating the extent of damage and determining the compensation amount, their allegiance lies with the insurance company that pays their salary or fees. This inherent bias in their role can have significant implications for property insurance owners seeking a fair settlement.

Biased Assessments for Insurance Company

The primary concern when dealing with insurance adjusters is their potential bias towards the insurance company’s interests. Insurance adjusters are trained to minimize the payout for claims, which directly benefits the insurance company’s bottom line. This means that their assessments may not accurately reflect the actual cost of repairing or replacing damaged property.

Limited Knowledge of Policyholder Rights

Insurance policies are often laden with complex legal language and provisions that can be challenging for the average policyholder to understand fully. Insurance adjusters are well-versed in these policies, giving them the upper hand in negotiations. Property owners may find themselves at a disadvantage when trying to assert their rights and receive the compensation they deserve. Furthermore, the insurance adjuster has no incentives to care about the insured’s rights. To put it bluntly in plain English, that is not the purpose for what they were hired to do.

Conflict of Interest (is Obvious)

Insurance adjusters, by definition of who is signing their checks, positions them as a direct conflict of interest when handling property insurance claims. They are accountable to their employers, who have a vested interest in minimizing claim payouts. This conflict can make it difficult for policyholders to trust that they will receive a fair assessment of their damages.

The Role of Public Adjusters is to Represent the Insured

On the other side of the equation, public adjusters serve as advocates for policyholders, representing their interests in property insurance claims. Unlike insurance adjusters, public adjusters work independently and are not affiliated with insurance companies. Public adjusters are hired by the property owner (the insured) to provide a fair assessment of damages and negotiate a just settlement on their behalf. Noble’s motto is, “Defense and Advocacy for the Insured” for a reason.

Advocates for the Policyholder

Public adjusters work exclusively on behalf of the property owners when needing to file a claim, making them invaluable advocates for policyholders. The sole focus is to ensure that the property owner receives the maximum compensation entitled under their insurance policy. In that sense, public adjusters significantly level the playing field by providing expertise and experience to counter the insurance company’s adjuster.

Expertise in Property Claims and Property Insurance Law

Public adjusters are state licensed professionals with extensive knowledge of property insurance policies and claim procedures. Public adjusters are experts in the intricacies of property damage assessment, estimating repair costs, and navigating the entire claims process. This expertise allows PA’s to provide a more accurate evaluation of damages, ensuring that policyholders receive what they are entitled to.

Experience and Expertise in Negotiating Property Insurance Claims

The critical roles of public adjusters is to negotiate with insurance companies on behalf of property owners. Possessing the experience and negotiation skills necessary to push for a fair settlement, public adjusters dramatically impact the likelihood of policyholders getting shortchanged by insurance companies.

Why You Should Hire a Public Adjuster

The advantages of hiring a public adjuster are clear, especially when facing the challenges posed by insurance adjusters who are inherently biased towards insurance companies. Here are more compelling reasons why property owners should seriously consider hiring a public adjuster:

- Expert Property Damage Assessment: Public adjusters possess the expertise to accurately assess property damage and calculate repair or replacement costs. Their evaluations are more likely to reflect the actual scope of the damage, ensuring that you receive fair compensation.

- Claims Management: Public adjusters handle the entire claims process, from documenting damages to negotiating with the insurance company. This alleviates the burden on property owners and allows them to focus on rebuilding their lives.

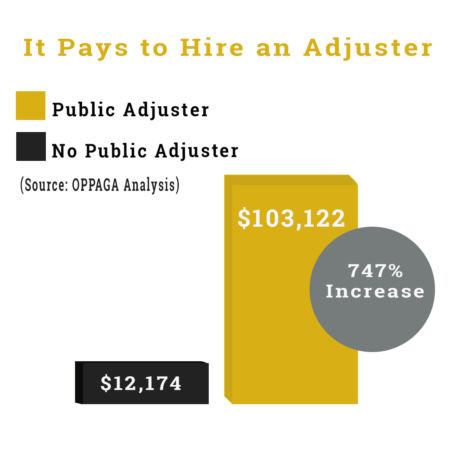

- Maximizing Settlement Compensation: Public adjusters are committed to maximizing your compensation. They work diligently to secure the best possible settlement within the terms of your insurance policy, ensuring that you are not left financially disadvantaged.

- Protection of Rights: With a public adjuster representing your interests, you have someone who understands your rights as a policyholder and can assert them effectively during the claims process.

- Peace of Mind: Knowing that you have an experienced advocate working on your behalf can provide peace of mind during a stressful and challenging time.

Hire a Reputable Public Adjuster

When it comes to property insurance claims, knowing the distinction between a public adjuster and an insurance adjuster can significantly impact the outcome. Insurance adjusters, while tasked with evaluating claims, are inherently biased in favor of the insurance company’s interests. This bias can result in underpayment for property owners. On the other hand, public adjusters are dedicated advocates who work exclusively for policyholders, leveling the playing field and ensuring that you receive a fair settlement.

In the aftermath of a storm or fire or any type of property damage, it is crucial to make informed decisions that protect your financial interests. Hiring a public adjuster is a powerful first step that empowers property owners to navigate the complex world of property insurance claims with confidence, knowing that their rights are being upheld and their financial well-being is being fought for with a bias for your best interests. Something Noble has a distinguished reputation for doing for our clients across the United States. Don’t settle for less than the best when it comes to your insurance claim.

Enlist the Largest & Best, Fully Staffed Public Adjuster Firm for Your Claim

I began my investigation and came across Noble Public Adjusting Group. I read the evaluations and decided to contact Tommy Browning; it was the finest decision I'd ever made; from the beginning, Tommy Browning was very professional and attentive, communicating with me at every stage about what was next or what to expect.

We received a check in the mail this week for the maximum coverage of our insurance; we are still astonished because we were not anticipating the entire amount. Thanks Noble!!!

WtApp>>>>> +16574647879

e-mail>>>>> [email protected]

contact her via:

Email: [email protected]

Whatsapp: +16574647879

whatsApp: +1 (925) 587-4914 EMAIL:[email protected]

I want to thank Noble PA group for assiting me with my hurricane claim. Although they could not assist further than a consultation Tyler Spalding was phenomenal. Tylers knowledge astounded me, at all times he was professional and courteous. I had spent months talking to my insurance company trying to get a direct response on why my policy wouldn't cover my damages. Within 2 days he reviewed my policy and gave me answers. The best part he never tried to sell me anything, or rope me into a contract. One word sums it up. Integrity.

Email: [email protected]

WhatsApp: +13523292265

Aerial handled everything flawlessly.

My wife and I could not be happier with this experience.

Highly recommended!!

Bob & Rita Potomski

I sincerely appreciate your efforts for helping me trading my $500 into $6,500

In just 6 working day's. and have been making successful withdrawal weekly, That's was awesome and unbelievable too. Now I see why everyone recommended you everywhere on Facebook no hidden charges so smooth . God bless you and strengthen you to do more for your clients ijn...

Contact Mrs Donald Maureen if you’re interested to trade and earn money through forex/Bitcoin investment.

Email: [email protected]

Whatsapp NO : +1 (563) 279-4193

Kelley

Pensacola FL

WhatsApp: +13523292265

Email: [email protected]

Thank you Daniel for everything…..We so appreciate everything you have done!

- Rachel Galione

Watch “Insurance Wars – Fiery Debate”. A Fire Insurance Claim Episode from Our Hit Reality TV Show

Much of our work is prominently featured on our well-received and popular television program, “Insurance Wars”. This show was created with the primary objective of providing insight into the genuine conflicts that arise between insurance adjusters and public adjusters when they work on claims for our esteemed clients. “Insurance Wars” serves as a platform for our clients to share their personal experiences, recounting the tumultuous situations that arise when their lives are disrupted by natural disasters, leaving them in urgent need of guidance and support.

Through “Insurance Wars,” we aim to dispel common misconceptions surrounding public adjusters by highlighting the extensive expertise and knowledge that our team members bring to the table.